What is this article about?

When building a blockchain project, you must choose a network, a decision that impacts speed, reliability, decentralization, and interoperability with other onchain applications. The challenge is choosing this without knowing how to compare networks effectively.

Bryan Routledge, an associate professor at Carnegie Mellon University's Tepper School of Business, highlights a significant dilemma: Traditionally, processing transactions at scale requires centralization (as seen in Visa's extensive computer network) while maintaining decentralization typically reduces speed (exemplified by Bitcoin's deliberately slower processing).

This article compares two platforms tackling this speed challenge with distinct architectures: Solana and Base.

Solana: Speed Through Architectural Innovation

Solana emerged in 2020 as a blockchain powerhouse, designed from scratch to deliver exceptional performance. Its architecture deploys a strategic approach, combining:

Proof of Stake (PoS): Secures the network and maintains decentralization through a robust validator network (1,300+ nodes, according to Solana's official data).

Proof of History (PoH): This creates a verifiable chronological record using verifiable delay functions that serve as cryptographic timestamps, dramatically reducing coordination overhead between validators and allowing parallel processing.

Parallelized Transaction Processing: Solana's true speed advantage comes from its parallel processing capabilities. The network distributes transaction workloads across multiple CPU cores simultaneously, processing thousands of transactions in parallel rather than sequentially, like Base.

This groundbreaking multithreading approach enables Solana to scale horizontally with hardware improvements, as each validator can leverage multiple CPU cores to process different transactions concurrently. Importantly, this parallelization and Proof of History (PoH) now drive Solana's industry-leading speed and affordability.

Solana is a Layer 1 blockchain, ie, it handles all transactions directly on its own network rather than relying on external systems for settlement. The result? Solana has transaction speeds that rival centralized giants like Visa, all while keeping its decentralized nature and security model.

Base: Leveraging Ethereum's Strengths

Base, an Ethereum Layer 2 solution built on the OP Stack and launched by Coinbase in August 2023, processes transactions off-chain to reduce fees before batch-settling them on Ethereum. These processed transactions are bundled together and sent back as a single block. Base then sends Ethereum a verified summary of these transactions, proving they're legitimate. This approach taps into Ethereum's deep liquidity, existing developer tools, and battle-tested security.

The OP Stack framework, launched collaboratively in October 2022 by OP Labs and the Optimism Collective DAO, offers essential components for developing a complete Layer 2 blockchain system with a modular design that allows for the replacement or enhancement of individual components:

Data availability layer: This is where all transaction data is stored so it can be accessed and verified by anyone on the network. Think of it as the public record-keeping system for the blockchain.

Transaction sequencing: This component determines the order in which transactions are processed. The sequencer receives incoming transactions, arranges them in a specific order, and creates batches to be processed. It's essentially the traffic director for all transactions.

Settlement layer (typically Ethereum): This is the foundation blockchain where the final, condensed results of all Layer 2 transactions are recorded. For Base, this is Ethereum, which provides the ultimate security guarantee for all transactions.

Customizable execution environments: These are the systems that define how transactions and smart contracts run. They can be tailored to specific needs, allowing developers to create specialized environments for different types of applications or use cases.

Various fault-proof systems: These are security mechanisms that ensure all transactions processed on Layer 2 are valid and can be verified. If someone tries to submit invalid transactions, these systems provide mathematical proof of the fraud, protecting users' assets and maintaining network integrity.

This architectural flexibility results in highly adaptable networks tailored to specific use cases while maintaining ecosystem compatibility.

Coinbase shows strong confidence in the OP Stack by becoming the second core development team contributing to its advancement alongside OP Labs. Base is the second major network built on this foundation, following Optimism's mainnet.

The Optimism Superchain Vision

Coinbase's participation in developing the OP Stack aligns with broader plans for an Optimism "Superchain" ecosystem, a network of Ethereum Layer 2 chains, each with its own ecosystem that shares common governance and bridging protocols through the OP Stack architecture, but mind you, these haven't happened yet. It's just Base and Optimism. Beyond technical contributions, Coinbase allocates a portion of all Base transaction fees directly to the Optimism Collective.

In this comparison, we contrast Solana's monolithic and performance-driven structure with Base's rollup-based modular approach. We closely analyze their consensus mechanisms and their methods of handling state, considering Solana's account model versus Base's state management in its rollup system and the trade-offs made to balance speed, cost, security, and scalability. While both platforms aim to address similar challenges, their differing approaches may influence users' choices depending on your specific use case, whether you are a developer creating a high-frequency dApp and integrating it into existing software or simply investing in blockchain technology. By the end of this article, you will be able to decide which platform is right for you.

Architecture and Design trade-offs

When examining Solana and Base architecturally, we look at two fundamentally different approaches to blockchain design: one modular and one monolithic. This distinction drives significant differences in how transactions are processed, data is stored, and security is maintained.

Solana: Monolithic Single-Layer Performance

Solana implements a high-throughput, monolithic blockchain architecture that processes all transactions directly on its primary layer. This approach delivers exceptional performance metrics:

Transaction confirmation time: Typically 1-2 seconds at the 'Confirmed' level.

Transaction fees: Approximately 0.0000025 $SOL per transaction (roughly $0.0001 in April 2025).

Architecture type: Self-contained, independent blockchain.

Base: Modular Layer 2 Ethereum Rollup

Base utilizes an optimistic rollup framework that processes transactions off-chain before batching and settling compressed data on Ethereum's mainnet. Key characteristics include:

Transaction confirmation time: 2-5 seconds for local confirmation, with final settlement on Ethereum after the challenge period, which is typically 7 days.

Transaction fees: Approximately 93.24% higher than Solana, roughly $0.02-0.05 per transaction, though Base fees can vary with Ethereum’s gas market.

Architecture type: Extension of Ethereum's ecosystem, relying initially on Coinbase for security before final settlement on Ethereum L1.

Transaction Speeds and Scalability

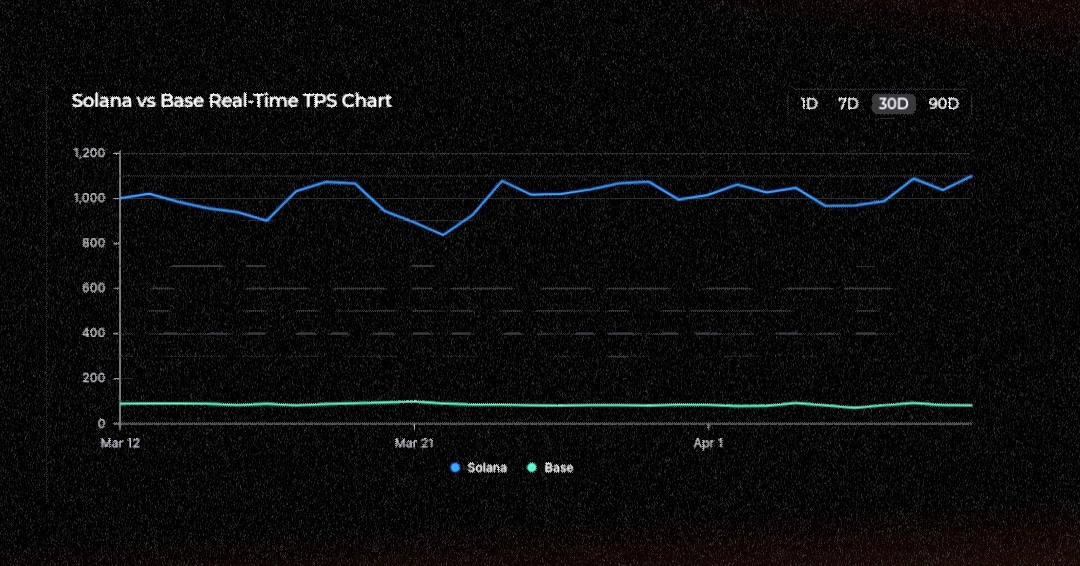

Solana: Processes 600 - 1,000 non-voting transactions per second (TPS) under real-world load. While its theoretical capacity reaches 65,000 TPS.

Base: Theoretically supports thousands of TPS as an optimistic rollup but averages 30–40 TPS with peaks up to 82 TPS in practice due to Ethereum settlement constraints.

Solana vs Base [TPS, Max TPS, Block Time & More] - Chainspect

Real-time TPS shows how many transactions per second the blockchain is processing.

This metric is calculated by taking different time intervals (hour/day/week/month) and calculating the total amount of transactions in them. Then, the number of transactions is divided by the number of seconds in an interval.

Only transactions with economic value are included; system transactions and transactions needed for consensus are excluded. Internal/inner transactions are not counted as additional transactions.

Max TPS (Max Recorded TPS) represents the highest number of transactions per second ever achieved by a blockchain.

This metric can be calculated in two ways:

1. Over 100 consecutive blocks: Calculated by dividing the total number of transactions in this period by the cumulative block duration in seconds (default view).

2. Per single block: Calculated using the block with the most transactions and the smallest block time.

Real-Time TPS Chart

Max Theoretical TPS shows how many transactions per second the blockchain is theoretically capable of handling.

This metric is calculated by taking the block size measured in gas/bytes/computational units and dividing it by the size of the smallest transaction possible to determine the maximum number of transactions that fit into the block (in most blockchains, the smallest transaction is a transfer of a native token). Then, the number of transactions is divided by the block time to compute the metric.

Total Transactions shows the number of transactions processed by a blockchain over a given period.

This metric is calculated by taking different time intervals (hour/day/week/month) and calculating the total amount of transactions in them.

Only transactions with economic value are included; system transactions and transactions needed for consensus are excluded. Internal/inner transactions are not counted as additional transactions.

Data Storage

Solana: On-chain (internal to cluster)

Base: Ethereum L1 (external)

Program / Smart Contract Capabilities

Solana: Smart contracts, known as ‘On-chain programs’ in Solana, can execute at high speeds and support complex decentralized applications. On-chain programs are generally written in Rust, which is known for its performance and security. Solana programs use common Rust tooling, so items like VScode’s Rust features and the Rust Analyzer plugin are commonly used to build programs. Solana has a dedicated Stack Exchange site.

Base: Base Smart Contracts leverage Solidity, the same programming language used in Ethereum. Its tooling and framework structure is tailored to reduce complexity for developers.

Uptime

Solana: As of April 2025, Solana mainnet has had 100% uptime in the last year, according to the Solana status page.

Base: As of April 2025, Base L2 has experienced some downtime. Specifically, on April 9, 2025, Base L2 faced another significant downtime event where transactions were stuck for over an hour, according to the Base status page. The Base network also has ‘scheduled maintenance’ periods, reflecting the centralized nature of the network.

Composability

Solana's transaction model leverages instructions as atomic units that enable powerful composability across the ecosystem. Each transaction can contain multiple instructions that call functions from any on-chain program, creating seamless integration between protocols. Its instruction-based architecture specifically facilitates transaction composability through explicit program-to-program calls. Developers stack instructions sequentially within a single transaction, ensuring atomicity while combining functionality from different programs.

For example, a developer can compose a single transaction that obtains a flash loan, swaps tokens on a DEX, establishes a position in a yield strategy, repays the flash loan, and logs the entire operation using the memo program. The blockchain ensures that all instructions are completed successfully or that he entire transaction reverts. Both client applications and On-chain programs can initiate these composable transaction flows.Base inherits the Ethereum account model, where smart contracts directly interact through function calls, creating deep composability chains within the ecosystem. The EVM's standardized interfaces enable smart contracts to communicate seamlessly. A Base developer can craft transactions where one contract calls functions across multiple protocols - swapping assets on Uniswap, supplying liquidity to Aave, and fetching Chainlink price data, all executing atomically within a single transaction flow.

While both platforms support function calls between On-chain programs, Base focuses on contract-to-contract communication patterns familiar to Ethereum developers. Base's Optimistic Rollup architecture preserves this composability model while dramatically reducing gas costs compared to Ethereum mainnet, making complex multi-step transactions economically viable for more use cases.

Consensus Mechanism

When evaluating blockchain platforms, their consensus mechanisms fundamentally shape performance characteristics, security guarantees, and network dynamics. Solana and Base represent contrasting philosophical approaches to this critical architectural component.

Architectural Foundations: Native vs Inherited Consensus

Solana implements a native Proof of Stake (PoS) consensus augmented by its proprietary Proof of History (PoH) protocol. This PoH mechanism creates a verifiable chronological record through a sequential pre-image-resistant hash chain functioning as a cryptographic timestamp. Each validator continuously runs the same SHA-256 hash function on the previous output.

Unlike Base's centralized sequencer model, Solana uses a PoH-based leader rotation schedule where validators produce blocks according to a predetermined sequence. When transactions enter the network, the system timestamps them using the current hash count, creating an immutable record of event chronology. This architecture dramatically reduces coordination overhead between validators and enables parallel transaction processing.

In contrast, Base operates as an Optimistic Rollup that inherits security from Ethereum's PoS consensus layer rather than implementing its own independent consensus mechanism.

This fundamental architectural difference distinguishes how each blockchain establishes transaction ordering and network security:

Solana stakes its security directly on its 1,300+ validators, who must reach an agreement through Tower BFT, a specialized implementation of Practical Byzantine Fault Tolerance (PBFT) that leverages PoH to reduce communication overhead. Tower BFT creates "vote lockouts," where validators face increasing penalties for attempting to revert previously confirmed blocks, reinforcing finality guarantees without sacrificing throughput.

Base does not operate its own set of validators; instead, it relies on this single sequencer, currently controlled 100% by Coinbase, to process and batch transactions before submitting them to Ethereum, which itself is secured by approximately 870k validators. Rather than implementing Byzantine fault tolerance directly, Base employs a fraud-proof system where external validators can challenge incorrect state transitions during a 7-day dispute window. This creates a fundamentally different security trade-off: Base transactions gain full Ethereum security only after this challenge period expires, offering a separate "soft confirmation" status for practical finality.

Consensus Mechanism Comparison: Balanced

Consensus Mechanism Comparison: Speed Priority

Consensus Mechanism Comparison: Security Priority

Transaction Finality: Speed vs Assurance

Solana's design prioritizes speed and throughput, achieving "optimistic confirmation" when a supermajority (>66.7%) of staked SOL votes for a block. This optimistic confirmation occurs within ~400ms, giving users a high confidence that their transaction won't be reversed, but it's not the complete story.

To achieve true "economic finality," Solana requires ~12 blocks (~6 seconds). This distinction matters because optimistic confirmation provides practical assurance for most use cases, while economic finality guarantees that reversing transactions would require attackers to burn substantial economic resources, making the cost of an attack prohibitively expensive.

By comparison, Base offers:

Base Finality: ~2 seconds for sequencer confirmation, ~7 days for cryptographic finality

This two-tiered finality approach gives Solana users the flexibility to choose between near-instant practical finality or stronger economic guarantees based on their specific risk tolerance.

Block time is the average amount of time it takes for a new block to be added to a blockchain.

This metric is calculated as an average based on different time intervals (hour/day/week/month)

Time To Finality (TTF) is the duration of time it takes for a transaction to be considered final in a blockchain network. It’s essentially the time it takes for a transaction to become permanent in a blockchain’s ledger.

Base employs a fundamentally different approach through its challenge period. Transactions are considered "confirmed" when included by the sequencer but remain theoretically reversible during a lengthy challenge window (typically one week). While this extended finality window appears inferior on paper, it enables Base to leverage Ethereum's security without inheriting its throughput limitations.

Centralization Dynamics: Stake Distribution vs Sequencer Control

Solana's stake-weighted voting mechanism creates natural centralization pressures:

Validators with larger stakes exert greater influence over consensus outcomes.

Current stake distribution shows significant concentration among large validators.

Economic incentives favor consolidation, as larger validators achieve economies of scale.

For example, a validator controlling 5% of staked SOL contributes 5% toward the crucial supermajority threshold needed for consensus, whereas smaller validators might contribute just 0.1% each. This creates practical differences in network influence despite theoretical permissionless participation.

Base faces a different centralization challenge:

Currently relies on a centralized sequencer operated by Coinbase

Plans phased decentralization of sequencer responsibilities

Even with sequencer centralization, fraud proofs theoretically ensure correct state execution

Each model presents distinct tradeoffs between immediate execution guarantees and longer-term trust assumptions.

Technical Innovations and Tradeoffs

Solana's PoH represents its most distinctive technical innovation for consensus. This mechanism creates a verifiable, cryptographic time record that:

Allows validators to process blocks efficiently without waiting for network-wide synchronization

Creates deterministic leader scheduling based on verifiable delay functions

Enables parallelized transaction validation through timestamp-based ordering

The tradeoff comes in implementation complexity and hardware requirements. Solana validators must maintain high-performance hardware specifications to participate effectively in consensus, creating barriers to entry for smaller operators.

Base leverages Ethereum's data availability layer through EIP-4844 blob storage, offering:

Compressed data posting that reduces L1 gas costs by ~10x

Inherited security from Ethereum without throughput constraints

Challenge-based verification that assumes honest execution but provides cryptographic fallbacks

This design permits Base to achieve higher throughput than Ethereum mainnet but with weaker immediate finality guarantees than Solana.

State Storage and Management

Account Models: Different Paradigms

Solana's account-based model stores state in separate data accounts (up to 10MiB each) managed by programs. This enables multiple accounts to be updated in parallel, significantly boosting throughput.

Base inherits Ethereum's storage architecture with its key-value store and 32-byte slots, where program code and data are bundled together. This fundamental difference means that in the Ethereum model (and thus Base), only one state item can be updated at a time, creating a processing bottleneck that Solana's parallel design avoids.

In practical terms: on Solana, a token program would create and manage distinct accounts for each token holder that can be updated simultaneously, while on Base, a token contract would track all balances in its internal storage mapping with sequential updates.

This architectural distinction highlights why Solana can achieve higher raw transaction throughput, while Base prioritizes compatibility with Ethereum's established development patterns and security model.

Data model

Solana: Solana stores data in granular accounts, meaning it’s more common to update data items in parallel. For example, if a single user receives USDC and USDT in separate transactions, Solana can process both transactions in parallel as they write to separate accounts. However, this also requires instructions to state explicitly the accounts used in each transaction.

Base: In the example given above, Base will use a batching mechanism that collects multiple transactions off-chain, orders them using a sequencer, and then submits them as a single batch to the Ethereum mainnet for verification.

Economic Models & Storage Costs

Both platforms address the "state bloat" problem differently:

Solana enforces a rent mechanism requiring accounts to maintain a minimum balance proportional to data size (refundable upon closure). This creates an economic incentive against unnecessary storage use. Developers must carefully consider data structures to minimize costs.

Base takes a fundamentally different approach by leveraging Ethereum as its data availability layer. While this removes explicit storage rent, developers still face gas costs for state modifications.

Validator Requirements & Decentralization Implications

Solana demands robust hardware from validators to handle state storage. Recommended specifications include 12-core CPUs, 128GB+ RAM, and NVMe SSDs with at least 2TB capacity. Storage is split between account partitions (current state) and ledger partitions (transaction history).

In contrast, Base's layered architecture distributes responsibility:

Ethereum's validator network handles data availability

Execution is managed by the sequencer and nodes running optimized LevelDB-derived storage

Settlement occurs through attestation-based fault-proof mechanisms

This architectural difference fundamentally reshapes the decentralization landscape for both networks. Solana's high hardware requirements narrow the validator pool, creating a technical barrier to entry for average users.

In contrast, Base actively taps Ethereum’s consensus to simplify validator access, letting anyone leverage its battle-tested security without running heavy nodes. But here’s the catch: Coinbase alone runs Base’s sequencer, giving it the power to filter transactions before they hit Ethereum’s final layer. This single choke point raises legitimate concerns about control, unlike Solana’s broader validator spread, which dodges that risk even if it demands beefier hardware.

Nakamoto Coefficient

The Nakamoto Coefficient measures how many entities would need to collude to compromise a blockchain network. It specifically quantifies decentralization by counting the minimum number of parties required to disrupt critical network functions.

Think of it as a blockchain's "decentralization score" - the higher the number, the more distributed the network's control points are. A Nakamoto Coefficient of 1 means a single entity controls the network, while higher numbers indicate better resistance against censorship or attacks.

For example, if 5 mining pools control enough hash power to execute a 51% attack on a proof-of-work blockchain, that network's Nakamoto Coefficient equals 5.

It will be worthwhile to acknowledge Base’s roadmap toward decentralized sequencers, which might improve this score over time.

State Finality & Trust Assumptions

Perhaps the most significant differentiator is how state finality works:

Solana offers rapid state finality, with state stored on the network’s high-capacity validators. While this approach provides near-immediate finality, the higher requirements for validators means that Solana has fewer validators than Ethereum mainnet

Base introduces a three-tier state model:

Trusted State - Updated based on sequencer information (fast but requires trust)

Virtual State - Updated based on Ethereum L1 data availability (slower but more secure)

Verified State - Updated after execution verification (highest security but slowest)

This gradient allows developers to choose their security/speed trade-off based on application needs. High-value financial applications might wait for a verified state, while gaming applications could leverage a trusted state for responsiveness.

Developer Experience & Storage Patterns

The divergent architectural approaches directly impact how developers structure applications:

On Solana, developers must explicitly manage account creation, size allocation, and ownership. The programming model requires thinking about data placement across accounts, a paradigm shift for developers accustomed to traditional databases or EVM contracts.

On Base, developers work within the familiar EVM storage paradigm but must optimize for gas efficiency due to the L1 data availability costs. This means carefully ordering variable declarations and minimizing storage writes.

In practice, this means Solana developers often create complex account structures optimized for parallel processing, while Base developers focus on storage slot packing and read/write operation minimization.

How does Solana's integrated, high-throughput approach compare to Base's rollup-centric roadmap?

Solana prioritizes raw performance through its architecture, enabling parallel transaction processing with optimistic confirmations in under half a second, though at the cost of higher validator hardware requirements and potential centralization pressures from stake-weighted economics.

Base leverages Ethereum's established security while sacrificing immediacy with its 7-day challenge period for final settlement. The fundamental difference extends to their data models as well:

Solana's account-based model allows direct data management and parallel updates that boost throughput but requires developers to explicitly handle account structures. Base reduces implementation complexity through familiar EVM compatibility and amortizes costs through batch compression, though it introduces sequencer trust assumptions that Solana's native execution avoids.

These architectural choices create distinct development environments – Solana offers greater performance potential but with higher complexity, while Base provides a more familiar programming model with robust security guarantees but less direct control over execution.

How do Solana's account-based data model and Base's EVM storage architecture create different trade-offs for developers building complex projects?

Solana's granular account model, as mentioned above, enables parallel processing but requires meticulous account planning. This creates a steeper learning curve where developers must predict account interactions and explicitly state which accounts each transaction modifies. The upside is tremendous throughput when properly implemented, as multiple transactions updating different accounts (for example, simultaneous USDC and USDT transfers to the same user or bets on different prediction markets in the same app) can be executed in parallel. Solana uses a Key/Value store called ‘program derived addresses’ to create individual data items, with unique addresses that are created from input seeds configured by the programmer.

Base's EVM key-value store simplifies development through conventional storage mappings but sacrifices this parallelism, requiring batch sequencing and settlement even for unrelated state changes. Solana's rent-based storage model demands upfront capital allocation but provides deterministic costs, while Base's compressed rollup approach avoids locked capital but subjects developers to Ethereum's unpredictable congestion pricing.

How do the consensus and finality models of Solana and Base impact their suitability for different types of financial applications?

Solana's sub-second optimistic confirmation (400ms) with economic finality in roughly 6 seconds makes it better suited for high-frequency trading and real-time financial applications where immediacy trumps absolute security guarantees. Its validator-powered native execution means no third-party sequencer stands between transaction submission and execution.

Base's two-tier finality model sequencer confirmation (~2 seconds), followed by a week-long challenge period, creates a fundamental tradeoff that favors applications where settlement certainty outweighs execution speed. Financial applications requiring maximum security might prefer Base's inheritance of Ethereum's massive validator set security, while those needing predictable fees benefit from Base's compressed data posting economics. The security models diverge sharply: Solana requires trust in its stake distribution economics, while Base requires sequencer trust but backs this with fraud proofs and Ethereum's security foundation.

Centralized Exchange Integration

The integration landscape for these networks reveals another key distinction:

Solana's exchange support evolved independently, building relationships across major trading venues, including FTX (historically), Binance, and OKX. While lacking the singular backing of a major exchange like Coinbase, Solana's performance characteristics drive organic adoption across trading platforms seeking to offer lower withdrawal fees and faster settlement times to their users.

Base enjoys native integration with Coinbase's extensive ecosystem, providing seamless fiat on/off-ramps and institutional-grade custody solutions. This Coinbase relationship facilitates regulatory compliance pathways that many enterprise applications require. Third-party exchanges like Binance and Kraken rapidly adopted Base support, recognizing its strategic importance in the Ethereum scaling ecosystem.

Real-World Implications and Future Evolution

These technical foundations create meaningful distinctions that shape deployment decisions:

High-frequency trading applications leverage Solana's parallelized execution and sub-second finality for arbitrage strategies and automated market-making where microseconds matter.

Maturity-focused financial deployments often gravitate toward Base's Ethereum-backed security model, leveraging Ethereum's 10-year proven track record over Solana's 5-year history, even if it means higher latency for robust settlement guarantees.

Cost structures reveal unexpected nuances—while Base employs clever compression techniques, Solana's architecture delivers consistently lower transaction fees in most benchmark scenarios, averaging $0.00025 versus Base's $0.0005-$0.001 range under typical conditions.

Governance philosophy represents perhaps the starkest contrast. Solana's validator-operated network embodies a decentralized approach where node operators collectively determine protocol evolution. Base's current reliance on Coinbase as a sequencer establishes a different trust model, though their roadmap suggests increasing decentralization.

Both networks continue refining their approaches. Solana focuses on stability enhancements through stake distribution incentives, QUIC-based propagation, and quality-of-service improvements. Meanwhile, Base progresses along its decentralization roadmap with planned sequencer networks, reduced challenge periods, and enhanced data availability solutions, It might also be worth mentioning that some organizations may like the week-long settlement period of Base.

Final Thoughts

Selecting between these platforms ultimately reflects your project's priorities:

For transaction-intensive applications requiring raw throughput and sub-cent transaction costs, Solana’s architecture prioritizes low-latency performance.

When Ethereum compatibility and exchange support drive requirements, Base provides a strategic on-ramp with minimized friction.

The competition between these contrasting technical visions benefits the broader ecosystem, as innovations flow between projects and push the boundaries of the blockchain scalability trilemma. Developers should evaluate not just current capabilities but the trajectory of each platform's evolution when making architectural commitments.

References and Additional Resources

Solana Documentation - Solana Foundation

The Solana Whitepaper - A.Yakovenko

Tower BFT: Solana’s High Perfomance Implimentation of PBFT - A.Yakovenko

The Solana Programming Model: An Introduction to Developing on Solana - Helius Blog

What is Solana? How does it work? - Forbes Advisor

Verified Delay Function - Cryptology ePrint Archive

Solana Status - Solana

Solana Beach - Solana

Base Documentation - Base Organisation

Base Status - Base

Optimism Stack - Optimism

State Management - Polygon Knowledge Layer

What is Base, Coinbase’s layer-2 network? - COINTELEGRAPH

Coinbase-backed Base to improve decentralization with fault proofs - COINTELEGRAPH

Solana vs Base [TPS, Max TPS, Block Time & More] - Chainspect

Solana vs. Base: A Comprehensive Blockchain Comparison - ARCH

Solana vs Base Chain: A Comparative Analysis - Bitget Wallet